I’ve created an order for a new bibliographic record. If I delete the order from the order list, does this also delete the bibliographic record?

No.

Can I change the order details after I’ve confirmed the order?

No.

Can I have different material types, order types and currencies on the same PO?

Yes.

Can I check in items from a cancelled or completed order?

No.

Can I accession items that are not checked in if my order is completed?

Items can only be accessioned if they have been checked in before the order was completed. Once an order is completed, no checking in is allowed, which means that the items were created, but have not been received. As such, even though the action of accessioning an item is separate from checking in, you can no longer accession these items as they will not be made available for issuing/returning.

Why can’t I see the fields for subscription start and end date in my order details?

Check that the processing options for the subscription order type have been set up correctly. These options are set up on the Order Processing tab in the Acquisitions General Parameters. The Order category must be set to “Subscription” if the Order type is subscription.

I’ve distributed the percentages evenly across all the funds in my fund pattern. Why are the funds not evenly distributed in the order details?

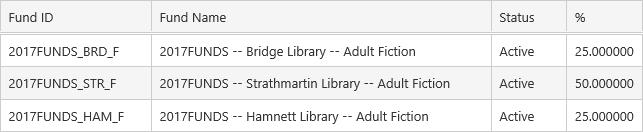

It’s probably because of the quantity. Let’s see an example. In our fund pattern we’ve distributed the percentages evenly across three funds:

- 2017FUNDS_BRD_F is 33.333333%

- 2017FUNDS_STR_F is 33.333333%

- 2017FUNDS_HAM_F is 33.333334%

But in the order details, the total fund allocation doesn’t appear to be evenly distributed. It’s 25%, 50% and 25%.

But this is because the quantity (in the order details) for the second fund is 2 whereas the quantity for the first and third funds is 1 — and hence 50% of the amount is taken from the second fund.

I’m trying to create a new order from a template, but the template I want to use isn’t listed. Why?

This is most likely because one or more of the funds used in the template has the status “Inactive” or “Expenditure only”, i.e. you can’t create a new order against this fund.

Why can’t I see any commitment in my specific Adjustment Charge/Tax Funds?

Specified Adjustment Charge/Tax Funds will only be expended amounts. However, if you use these funds in other areas (e.g. for Separate Taxes or Separate Charges) on an order/invoice, these amounts will be reflected in the Commitment column when the order is confirmed.

Why can’t I confirm my pending order?

This is probably because the order has expired. Check the order expiry date in the Order group box.