To set up the debt collection parameters:

- From the Module Menu select Maintenance, Circulation and then Debt Collection Parameters.

- Set up the parameters you want (see below for details).

- Click Save or Save & Close.

Charge selection

Minimum balance. The total amount of fines and charges owed by the borrower.

Grace period (days). Only consider charges created more than “n” days ago when calculating the borrower’s minimum balance.

Charge cutoff date and Days. Only consider charges created after the Charge cutoff date or less than “n” Days ago when calculating the borrower’s minimum balance.

Exclude charges. Select any charge codes to be excluded when calculating the borrower’s minimum balance.

If a borrower meets the charge selection criteria then all charges are included when calculating the total amount owed. It’s this total amount that’s submitted for debt collection. Overdue fines on non-returned items that have not been declared lost are excluded from the calculation of the borrower’s minimum balance and from the total amount owed.

Borrower

Exclude categories. Select any borrower categories to be excluded from submission, e.g. staff.

Exclude traps. Select any borrower traps to be excluded from submission, i.e. borrowers with the selected trap won’t be submitted.

Minimum age. Exclude any borrowers younger than the Minimum age who don’t have a link to a parent borrower.

Processing fees

Specifies additional fees to be applied to the borrower when he/she is submitted for debt collection. For example, you might add a charge for the debt collection fee and select that.

Send. Select this option to email the output file.

To, From and CC. Specifies who to email the output file to.

Submission subject. The text to appear as the subject for submission emails.

Update subject. The text to appear as the subject for update emails.

Synchronisation subject. The text to appear as the subject for synchronisation emails.

Emails are not sent when you run the notification in validation mode.

Secure FTP

Spydus currently uses emails to send debt collection files to the Unique Management Services server. To comply with General Data Protection Regulation (GDPR) Unique are looking to receive all files via a secure file transfer protocol (SFTP). To make this possible, we've added Secure FTP fields to the Debt Collection Parameters.

Other

Output directory. Specifies where the output files are to be saved. This is relative to the wwwroot folder.

The submission file has the format:

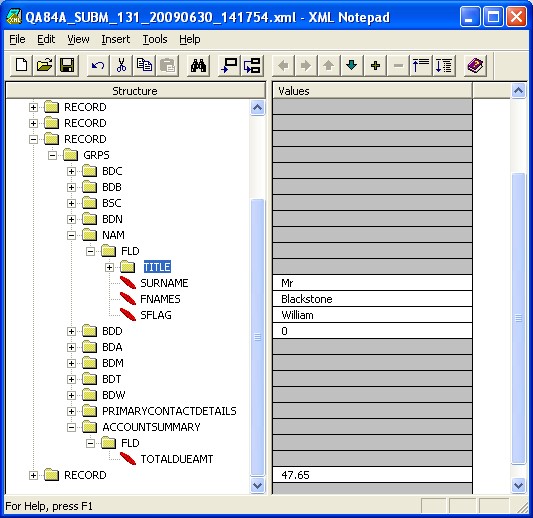

{institution code}_SUBM_{process ID}_YYYYMMDD_hhmmss}.xml

The update file has the format:

{institution code}_UPDT_{process ID}_YYYYMMDD_hhmmss}.xml

The synchronisation file has the format:

{institution code}_SYNC_{process ID}_YYYYMMDD_hhmmss}.xml

Set borrower trap and Trap note. Specifies a trap and a note to be set against the borrower when he/she is submitted for debt collection. For example, you might add a borrower trap for debt collection and select that.

Override borrower account groups. The following BRW groups are always output.

BDB – Branch.

BDC – Category.

BSC – Traps.

If you want to output other BRW groups then specify them here. Separate the groups with a closing square bracket. For example, to include borrower’s messages, status and registration expiry date in the output file specify:

BMM]BDS]BDX

Override borrower details groups. The following BRWD groups are always output.

BDA – Address.

BDD – Date of birth.

BDM – Mailing address.

BDN – Barcode.

BDT – Telephone numbers.

BDW – Guarantor.

BSC – Traps.

EFD – Temporary addresses and dates.

FML – Family link.

NAM – Name.

If you want to output other BRWD groups then specify them here. Separate the groups with a closing square bracket.

Below is an example of an output file showing the groups.

Debt collection scheduled task

To automatically run debt collection notifications weekly, monthly etc requires configuration of a scheduled task.

|

Please contact Civica Support for assistance as commissioning is required. |