The ability to set up the new fund control and funds before the rollover allows you to set up funds for purchases to be made in the next financial year in advance of the start of that financial year. These can be used for new commitments (e.g. pre-publication orders), whilst still spending up funds for the current financial year, if required, so that these commitments do not need to be rolled forward.

The new funds may initially have a status of "Commitment only" allowing orders to be placed but preventing invoice payment. As part of the rollover process, they can be made "Active".

The benefit of this approach is that the commitment totals for the current year’s funds will more accurately reflect the true year end position, as orders unlikely to be received before the new financial year will be linked to a separate set of funds.

Another reason why you might set up the fund control and funds for the new year in advance of the rollover is where there are changes to be made to the fund structure for the new financial year. If you've recently converted from another system you may find that you need less complexity of funds in Spydus to achieve the reporting capability that you require. The year end rollover process is a good opportunity to make this change. The mapping process inherent in the rollover to an existing fund control ensures that outstanding orders attached to an old fund are moved into the most suitable fund in the new structure.

For some structural changes e.g. from a location-based structure to a stock category-based structure, a fund may need to be retained initially for each location just to clear out the outstanding orders, but as long as no new orders are created for that fund during the new financial year, it can be excluded from the rollover the following year.

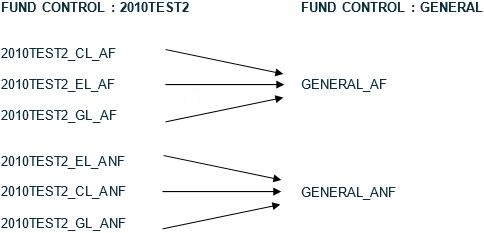

In the simple example below, we will rollover three funds from an existing fund control into a single new fund in another fund control. We'll transfer all remaining commitment from the old funds and make them inactive.

Setting up funds before the rollover

The target fund control/funds must already exist before you can follow this process. You would create the new fund controls and funds, and allocate them a new budget either before or after the rollover.

This would be an ideal time to create generic fund control IDs which do not contain the year in the ID (the year can still be entered in the description as this changes each year).

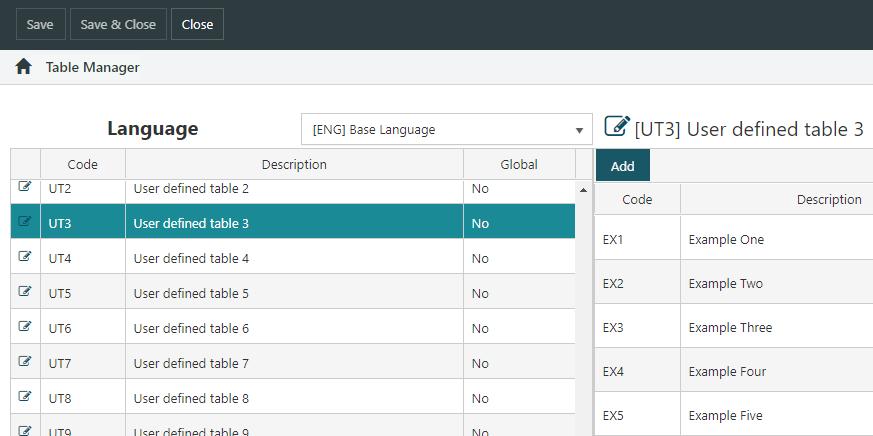

Fund controls can generate the fund names from any existing Spydus table, e.g. Location, Collection, Item Category or Stock Rotation Plan. Your System Manager should be able to give you a list of the entries in any table. Alternatively your System Manager can add a list of the fund names that you want to include to a selected user-defined table (UT1 – UT19), for example:

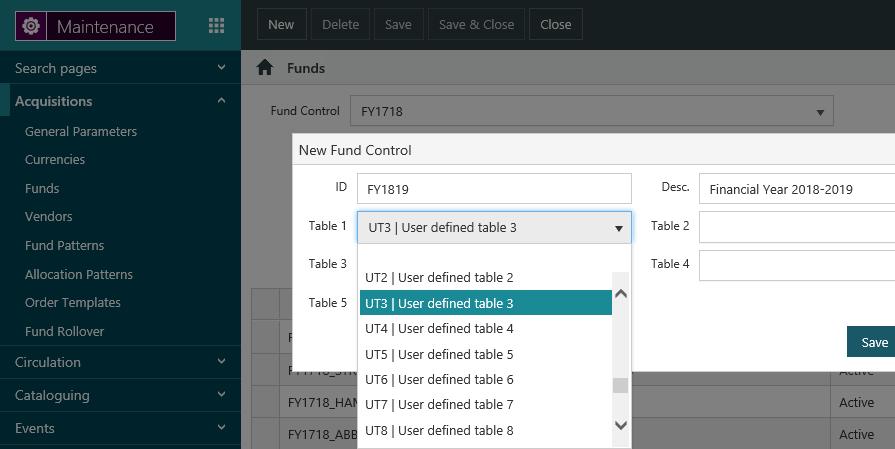

Once you have identified or set up a table with suitable values then you can create fund control(s) based on that table (in combination with up to four other tables).

When the fund control is set up, you can no longer add any more tables to it, so add all the ones you want to use to generate the fund names before saving it.

Once the fund control is set up you can add the funds and select values from the tables. You have to choose an entry from each table, you can’t leave any blank.

Remember to set the Start date and End date appropriately. The fund cannot be used before the start date or after the end date. You do not have to add a budget in order to save the fund.

Rolling over

To rollover into existing funds:

- From the Module Menu select Maintenance, Acquisitions and then Fund Rollover.

- Click Rollover into existing funds.

- Select the fund control for the target funds, i.e. for the funds to rollover into. This lists all the funds under the control. You can remove any you don't want to rollover into.

- Click Next.

- Select the fund control for the source funds, i.e. for the funds to rollover. This list all the funds under the control. Click Add for the ones you want to rollover, or Add All.

Repeat step 5 to rollover funds from other fund controls.

- Click Next.

- Set the rollover options.

- In the "Funds Mapping" table, select the target fund for each source fund.

- Click Next.

This is the last point at which the rollover process can be cancelled.

- Click Start Rollover.

You'll see a confirmation message when the rollover is complete. The time it takes to complete the rollover will depend on how many funds you've selected and how many line items there are.